For all the debate it generates, two things about the US health care system are indisputable: It’s getting more expensive and more difficult for employees to navigate. Employers expect their health care costs to increase 5.5 percent this year, up from a 4.6 percent bump in 2017, according to a survey by Willis Towers Watson. And employees are also feeling the pocketbook pinch. Annual deductible costs per patient rose 256 percent between 2004 and 2014, according to the Kaiser Family Foundation.

At the same time, employees find it difficult to get the care they need and to pay for it. They face daunting, now routine questions: “How do I pick my health insurance? How do I find the right providers for me? Why don’t I know how much a visit or procedure will cost before it happens?” That confusion and complexity doesn’t pay off with better health outcomes, either. In fact, quite the opposite: Compared with other developed countries, the United States has lower life expectancy and more chronic health conditions.

Fortunately, employers can leverage digital health platforms to help employees get the answers to these and many other questions — easily and efficiently. That can lower employee frustration and expense, while improving health outcomes.

Right this way

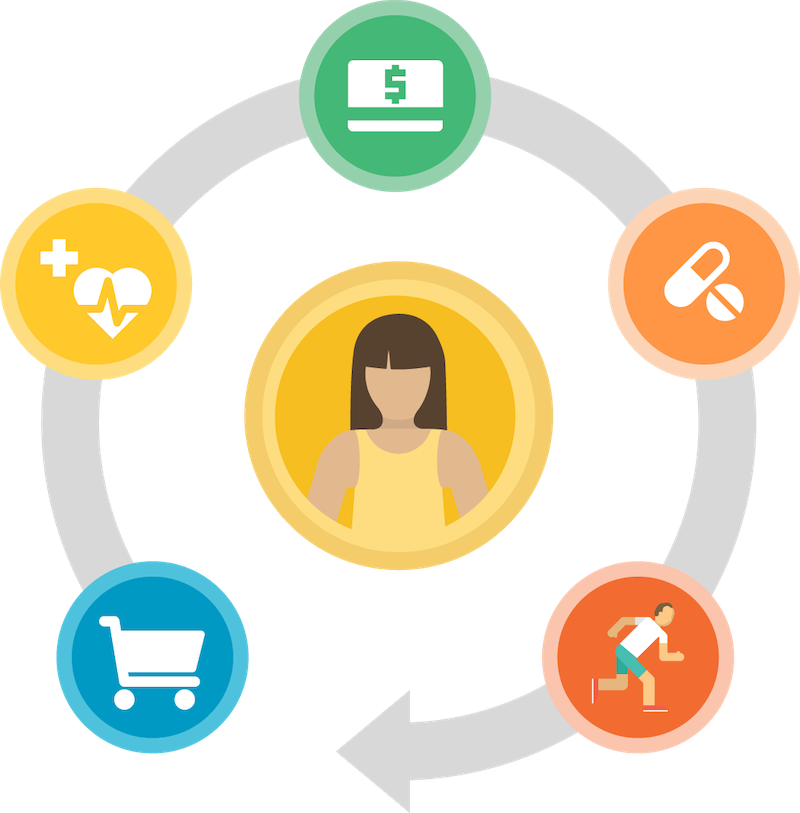

As a one-stop shop, digital health platforms guide consumers through the entire health care journey: selecting insurance, choosing doctors, estimating and comparing costs, paying for care, and managing their long-term well-being through preventive care and lifestyle programs. These platforms help consumers find and pay for high-quality, affordable care and adopt healthy behaviors — the two factors that account for 60 percent of personal health, according to the New England Healthcare Institute.

Savvy employers know that consumers no longer see digital health services as a nice-to-have. More than 75 percent of all patients expect to use digital health care services in the future, and digital use is expected to increase across all age groups, according to McKinsey consulting.

Yet while employers increasingly rely on digital benefits platforms, fewer than half (45.5 percent) say they most likely will stick with their current vendors, according to the IT advisory firm Pacific Resources. What are they looking for and not yet getting? “Employers want a more holistic approach to strategic benefits delivery,” Sean Clem, vice president of technology, marketplace and engagement solutions at Pacific Resources told the Society for Human Resource Management (SHRM). “They want to integrate the right products, user-friendly technology and clear communications so they can offer the right benefits to employees and their families.”

In other words, digital health platforms are not interchangeable. While some deliver value across the entire consumer journey, others manage only part of consumers’ health care needs, leaving employees or employers to find their own stopgap measures.

Sizing up solutions

Truly effective digital platforms help consumers complete the entire health care loop all in one place — a place that’s as accessible and user-friendly as Amazon, Netflix, or any other app consumers use. These platforms simplify the mess of shopping and paying for health care. They turn the confusing, fragmented US health care experience into a clear, unified one.

When comparing digital health platforms for employees, employers would be wise to look for tools that allow consumers to:

1) Select (and understand!) their insurance.

With the right digital health platform, consumers can compare different insurance plans and prices. They can enroll themselves and their dependents into plans. And the platform clearly explains concepts like HMO versus PPO, or HSA versus FSA.

2) Choose their care.

This doesn’t mean a simple dropdown of doctors’ names. Today’s consumers are savvy and discerning. They want to access provider ratings, including both consumer reviews and verified scores for primary care physicians and specialists. They want to compare prices for specific services, such as office visits and medical procedures. And they expect to be able to find their care quickly and seamlessly.

3) Pay for their care.

We wouldn’t tolerate being surprised by the cost of any other goods or services we get, like checking into a hotel or buying a car; health care should be no different. Digital platforms can inform consumers of their copays, prescription prices and doctor-visit fees. Consumers find the exact prices for their procedures based on their own health plans, not just local averages. They manage their FSA and HSA funds. And they pay copays and other bills online or via a mobile app.

4) Manage their prescriptions.

When a digital health platform spans the entire customer journey, it means physicians and pharmacists have the right insurance info at their fingertips — and patients are less likely to face sticker shock and frustration at the pharmacy. Instead, consumers are prescribed the right medications for their needs and plans, whether generic or brand name. They can locate their nearby pickup places or opt to receive their prescriptions by mail. For routine medications, they can set up automatic refills.

5) Stay healthy.

Keeping chronic conditions under control is great — but preventing those conditions in the first place is even better. If the digital health platform you’re considering doesn’t include a preventive approach, that should give you pause. Employees crave effective employer-sponsored wellness programs, and 87 percent of employers say increasing employee engagement in health and well-being is a top priority, according to risk management company Willis Towers Watson.

Making it a priority doesn’t mean adopting a tack-on solution or separate vendor that gets lost in the shuffle. It means prioritizing it front and center in employees’ health tools, giving them the information and motivation they need to make healthy diet, fitness and well-being choices.

Any employer who has juggled multiple vendor relationships knows that convenience is reason enough to streamline things behind the scenes. But the end result of finding a digital health platform that spans the entire consumer journey is not just convenience. It’s better health.

For example, when one payer used the Rally HealthSM platform, 46 percent more people found a primary care provider and 57 percent more selected a high-quality doctor who matched their needs, compared with the previous patient onboarding system. In addition, 10 percent more visited urgent care facilities instead of high-cost emergency rooms. Every percentage point is reason to celebrate, as unnecessary emergency room visits translate to high (and avoidable!) health care costs. And helping employees find the right provider and right point of care can also help dramatically rein in expenses, while improving both the patient experience and health care outcomes.

A digital health platform that makes life better for consumers makes life better for their employers, too.

Rhett Woods is chief creative officer and co-head of product at Rally Health, Inc.